Our sustainability strategy is fundamental to achieving our long-term vision. By embedding sustainability in our business strategy, we balance risk and deliver strong growth, while creating a positive impact on people and the environment. At Tata Communications, we prioritise providing sustainable value to our customers and a wider community of stakeholders, despite challenges, such as industry volatility and financial difficulties.

Way forward

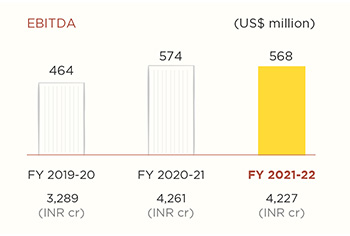

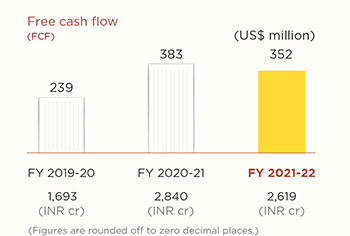

We will continue to strengthen our financial resilience to grow sustainably in the future. Our endeavour is to achieve double-digit data revenue growth, along with targeting EBITDA margin and RoCE in the range of 23-25% and 25-30%, respectively in the medium term. We also plan to pay dividends in the range of 30-50% of our underlying consolidated profit as envisaged in our revised Dividend Distribution Policy

Our key strategy is to develop next-gen products, focusing on higher returns and reviewing our pricing mechanisms to remain competitive. The focus will be to further strengthen our balance sheet, generate strong cash flows and improve working capital efficiency. We will continue to prudently invest in our business and return more value to our shareholdrers.

Adding value to stakeholders

Financial stakeholders

Value creation that leads to not just economic growth but also holistic growth, is the defining cornerstone of our business model. We constantly strive to create value for all our stakeholders by ensuring sustainability of operations, continuous innovation, and effective communication. Equipped with these intrinsic capabilities, we explore new opportunities that go beyond short-term gains and pave the way for lasting growth.

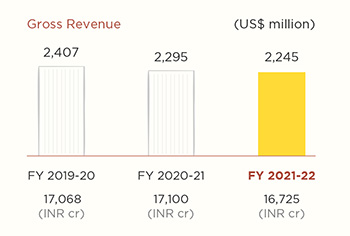

At Tata Communications, we are committed to doing our business the right way, applying the best practices, and continuously assessing our performance against financial and non-financial parameters. In FY 2021-22, our revenue is US $2,245 million (INR 16,725 crore). Our EBITDA for the year stood at US $567.3 million (INR 4,227 crore), and profit after tax is at US $199.3 million (INR 1,485 crore). The performance this year has been evidently strong. Our net worth is positive, and our liabilities are in a comfortable range. The Board of Directors recommended a dividend of US $0.28 (INR 20.70) per share as our Company generates sufficient cash flow to fund future corporate growth. There were no political contributions made this year.

Economic value contribution (INR values in crore, US$ values in million)

| A | Direct economic value generated and distributed (EV&D) on an accrual basis, including the basic components for the organisation’s global operation as listed below. If data is presented on a cash basis, report the justification for this decision, in addition to reporting the following components: | Unit | FY 2019-20 | FY 2020-21 | FY 2021-22 |

|---|---|---|---|---|---|

| i | Direct economic value generated | ||||

| 1) | Revenues* | INR | 17,137.67 | 17,256.86 | 17,056.82 |

| US$ | 2,417.53 | 2,324.12 | 2,289.51 | ||

| ii | Economic value distributed: | ||||

| 1 | Operating costs | INR | 12,969.41 | 11,955.23 | 11,554.34 |

| US$ | 1,829.53 | 1,610.11 | 1,550.92 | ||

| 2 | Employee wages and benefits | INR | 3,039.14 | 3,049.09 | 3,040.34 |

| US$ | 428.72 | 410.65 | 408.10 | ||

| 3 | Payments to providers of capital | INR | 623.65 | 535.41 | 761.84 |

| US$ | 87.98 | 72.11 | 102.26 | ||

| 4 | Payments to government by country | INR | 309.12 | 503.50 | 614.02 |

| US$ | 43.61 | 67.81 | 82.42 | ||

| 5 | Community investments** | INR | 15.78 | 11.85 | 14.28 |

| US$ | 2.23 | 1.60 | 1.92 | ||

| iii | Economic value retained: | ||||

| 1 | ‘Direct economic value generated’ less economic value | INR | 180.57 | 1,201.78 | 1,072.00 |

| US$ | 25.47 | 161.85 | 143.89 | ||

| Fx conversion rate | 70.89 | 74.25 | 74.50 | ||

* Revenue plus other operating income and other income

** Total CSR expensed amount

Employees

We create value for our employees by providing a robust, supportive, and exciting work environment, and enabling them to benefit from working for us. Our rewards and benefits practices are designed to increase motivation and satisfaction.

(INR values in crore, US$ values in million)

| Coverage of the organisation’s defined benefit plan obligations | Currency | FY 2021-22 |

|---|---|---|

| Salaries and wages | INR | 2,908.46 |

| US$ | 390.40 | |

| Defined contribution pension scheme costs | INR | 30.58 |

| US$ | 4.10 | |

| Defined benefit pension scheme costs | INR | 101.30 |

| US$ | 13.60 | |

| Share-based payment charge | INR | - |

| US$ | - | |

| Total | INR | 3,040.34 |

| US$ | 408.10 |

Community

We believe in the common development of all stakeholders. Companies create true economic value only when they create social value. We will respond positively to the changing needs of society. We are involved in CSR activities in all our global businesses.

US $2,245 mn

(INR 16,725 crore) FY 2021-22 gross revenue