A concatenated SMS (Short Message Service) refers to joining multiple messages to overcome the character limit of an SMS message (160 characters). With SMS...

SMS OTP Verification Services: How They Work, Use Cases, and Security Factors

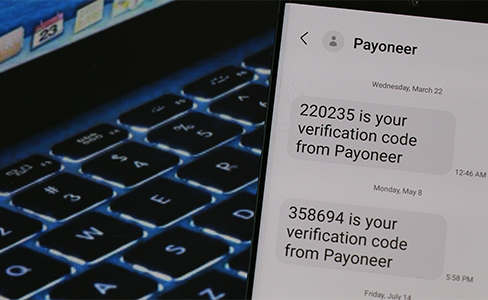

SMS OTP verification is one of the most trusted methods for securing user actions, such as logins, payments, and registrations. It sends a one-time password via SMS to confirm a user's identity in real-time. This method is quick, easy to use, and widely accepted across industries. From banks to eCommerce platforms, businesses rely on it for secure and smooth customer experiences. Service providers like Tata Communications Kaleyra help deliver OTPs instantly and reliably, even at scale. Whether you're protecting accounts or confirming transactions, SMS OTP verification plays a key role in modern digital security.

What Is SMS OTP Verification?

SMS OTP verification is a method used to confirm a user's identity by sending a one-time password (OTP) to their mobile phone via SMS. The user must enter this unique code to complete actions like logging in, making payments, or resetting passwords. It adds a layer of security and ensures that the rightful user acts. Many businesses use this method because it's quick, simple, and works on all mobile phones. Services that allow users to receive online OTPs via SMS are also growing, especially for those who prefer not to use their phone numbers for verification.

How SMS OTP Works Behind the Scenes

Have you ever wondered how SMS OTP works in the background? Let's break it down into simple steps.

Generating and Sending OTPs

When a user initiates an action that requires verification, such as logging into an account or completing a transaction, the system generates a unique one-time password (OTP) first. This OTP is usually a 4-6 digit number created randomly for that specific session. Once generated, the OTP is linked to the user's mobile number. It's then sent through a secure SMS gateway, like those offered by Tata Communications Kaleyra. These gateways are responsible for delivering the OTP instantly to the user's phone. Some users also prefer to receive an online OTP via SMS using temporary virtual numbers, which are helpful for testing or when privacy is a concern.

Verifying User Input Securely

After receiving the OTP, the user enters the code into the app or website. The system then compares the input with the one-time password (OTP) it originally generated. If the two match and the code is entered within a short time frame (usually 3–5 minutes), the action is approved.

If the entered code is wrong or expired, the verification fails, and the action is blocked. This process ensures that only the rightful user, who has access to the linked mobile number, can complete the task.

This entire OTP SMS verification flow happens within seconds, providing strong security without adding complexity for the user. That's why it's trusted by banks, e-commerce sites, and service platforms across the globe.

Also Read: RCS vs SMS: What’s the Difference?

Benefits of Using SMS OTP for Verification

SMS OTP verification is one of the simplest and most secure ways to confirm a user's identity. Whether it's for logging in, making a payment, or resetting a password, sending an OTP via SMS gives businesses a quick and effective way to keep accounts and data safe. Once you understand how SMS OTP works, you'll see why it's widely used across industries. Below are the key benefits that make it so popular.

Easy to Use for All Users

Users don't need to install any app or have technical knowledge. A one-time password is sent to their phone, and they enter it on the screen. It works with all mobile phones, making it convenient for everyone.

Quick and Real-Time Verification

The process is instant. The OTP is generated and sent within seconds, allowing the user to complete the action without delay. This smooth experience keeps customers satisfied and reduces drop-offs during sign-up or login.

Works Without Internet Access

Since it's sent through SMS, the user doesn't need the internet to receive the OTP. This is a significant advantage in areas with poor data connectivity, making OTP via SMS a reliable choice for all types of users.

Adds a Strong Security Layer

Even if someone knows your login details, they can't complete the action without the OTP. This added step helps prevent unauthorised access and protects sensitive information, especially in banking and online payments.

Cost-Effective for Businesses

Compared to hardware tokens or biometric tools, SMS OTP verification is a low-cost and easy-to-set-up option. With providers like Tata Communications and Kaleyra, businesses can manage large-scale OTP delivery without heavy infrastructure.

Also Read: MMS vs SMS: What’s the Difference?

Best Practices for Implementing OTP via SMS

Providers like Tata Communications and Kaleyra ensure fast, reliable delivery, but these practices help you get the most out of every OTP via the SMS process.

Use Time-Limited OTPs

Make sure every OTP expires within a few minutes, ideally 3 to 5. This reduces the risk of misuse and ensures the code is only used during a valid session. It also encourages users to act quickly.

Limit OTP Attempts

Let users try only a limited number of times, usually three to four, to enter the correct code. Too many wrong attempts may signal fraud, so blocking the session after a few tries helps improve security.

Avoid Reusing OTPs

Every OTP should be unique and used just once. Reusing old codes, even by mistake, weakens the system and creates a security risk. Generating a fresh code each time keeps the process safe.

Confirm Mobile Number Before Sending OTP

Always double-check the mobile number before triggering the OTP. If the number is wrong, the message may be sent to the wrong person or not delivered at all especially when users receive SMS online OTP through temporary numbers.

Work with Trusted SMS Gateways

Partner with reliable service providers like Tata Communications and Kaleyra. They ensure fast delivery, handle large volumes smoothly, and offer tracking so you can monitor every step of the SMS OTP verification journey.

Keep the Message Clear and Simple

Your OTP message should be easy to read. Mention the code clearly, explain what it's for, and avoid adding too much text. A simple, direct message reduces confusion and entry errors.

Conclusion: SMS OTP Verification – How It Works and Why It Matters

SMS OTP verification is a simple yet powerful way to secure user actions like logins, transactions, and account updates. It works by sending a one-time password directly to a user's phone, which must be entered to confirm identity. This process is quick, widely accessible, and doesn't depend on internet access, making it ideal for users across all locations. With reliable delivery and system integration, providers like Tata Communications Kaleyra help businesses implement OTP services at scale, with high delivery rates and complete security.

Explore other Blogs

Text marketing continues to be a potent tool for customer engagement in 2024, offering businesses a direct channel for customer interactions. With the integration of...

SMS is a convenient communication channel for businesses to connect with customers. Let’s learn about the role of Promotional and Transactional SMS notifications in...

What’s next?

Experience our solutions

Engage with interactive demos, insightful surveys, and calculators to uncover how our solutions fit your needs.

Exclusively for You

Get exclusive insights on the Tata Communications Digital Fabric and other platforms and solutions.